tulsa oklahoma auto sales tax

How much is tax by the dollar in Tulsa Oklahoma. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does.

The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales.

. Lawmakers passed House Bill 2433. Oklahomas motor vehicle taxes are a combination of an excise sales tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem property taxes. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

The tulsa sales tax rate is. Counties and cities can charge an additional local sales tax of up to 65 for a. Depending on the zipcode the sales tax rate of tulsa may vary from.

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. 918 Auto Sales Tulsa auto dealer offers used and new cars. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. The December 2020 total local sales tax rate was also 8517. Depending on local municipalities the.

This includes the rates on the state county city and special levels. What is the retail sales tax in Oklahoma. This is the largest of Oklahomas selective sales taxes in terms of revenue generated.

The Oklahoma sales tax rate is currently. Tulsa has parts of it located within Creek County Osage. State of Oklahoma - 45 Tulsa County -.

Great prices quality service financing and shipping options may be available We Finance Bad Credit No Credit. Sales Tax in Tulsa. Tulsa OK Sales Tax Rate.

Oklahoma sales tax details The Oklahoma OK state sales tax rate is currently 45. This is the total of state county and city sales tax rates. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

Oklahoma has a 45 statewide sales tax rate but also has 471 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 426 on. Typically the tax is determined by. The current total local sales tax rate in Tulsa OK is 8517.

State of Oklahoma 45. 325 of the purchase price or taxable value if different Used. Tulsa County 0367.

Inside the City limits. OKLAHOMA CITY Car dealers are asking the Oklahoma Supreme Court to prevent a law putting a sales tax on vehicles from taking effect. Standard vehicle excise tax is assessed as follows.

The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

What is the sales tax rate in Tulsa OK. 7288 tulsa cty 0367 7388 wagoner cty 130 7488 6610 washington cty 0409 1. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

City 365. The average cumulative sales tax rate in Tulsa Oklahoma is 831. Together these two motor vehicle taxes produced 728 million in 2016 5 percent of all tax revenue in.

State of Oklahoma 45. An average value for all such model vehicles is utilized.

Used Cars In Tulsa Ok For Sale Enterprise Car Sales

Used 2018 Chevrolet Trax For Sale In Tulsa Ok Edmunds

Real Photo Tulsa Oklahoma Uptown Theatre Advertising Postcard Copy Old Cars Ebay

Recent News Assistance League Tulsa

Search Our Inventory Regal Car Sales And Credit Tulsa Ok

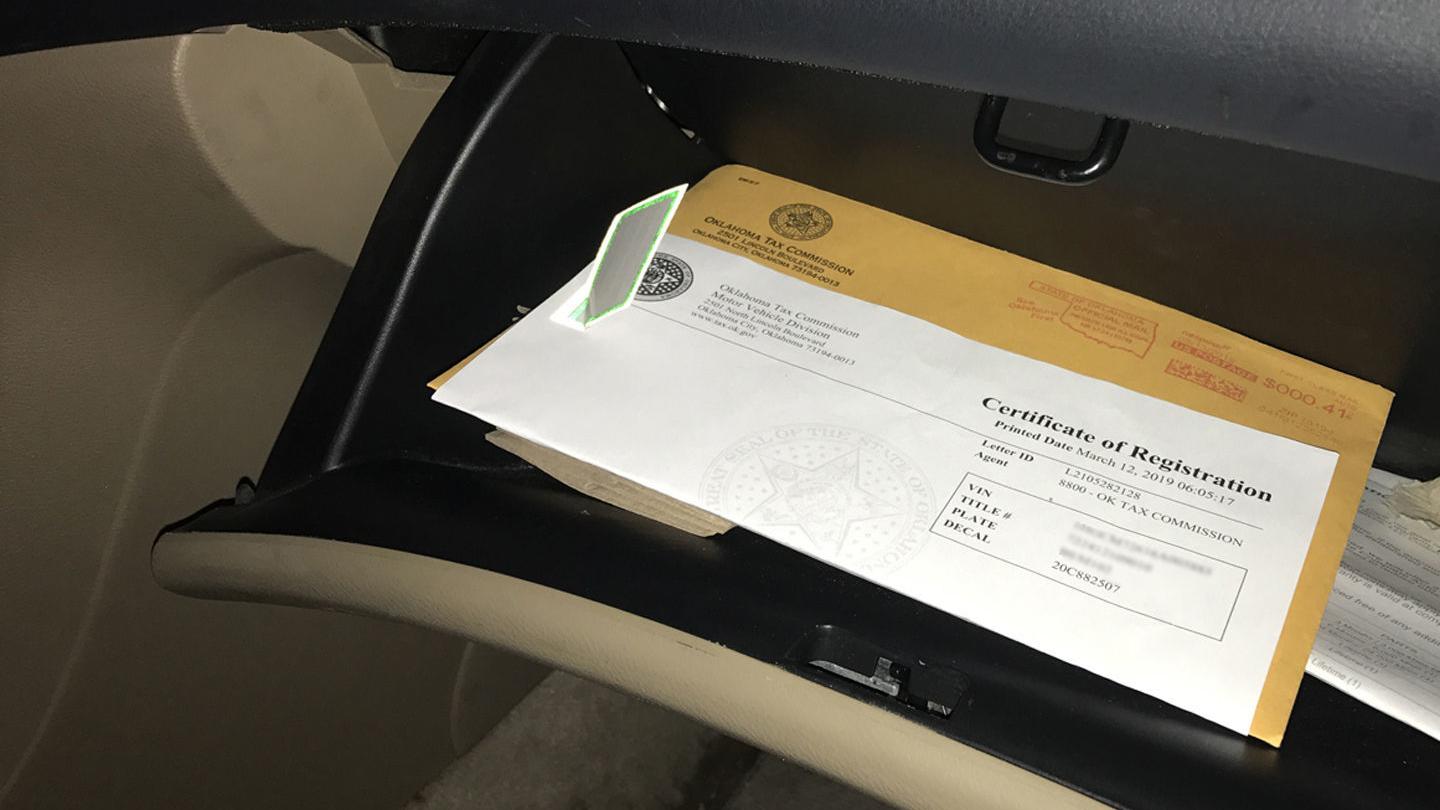

Update State Will Email Free Registration Certificates After Law Change That Also Keeps Plates With The Driver Local News Tulsaworld Com

Free Oklahoma Motor Vehicle Bill Of Sale Form Word Pdf Eforms

New Cars Trucks Suvs In Stock Jenks Nelson Mazda Tulsa

Pre Owned 2017 Chevrolet Trax Ls For Sale In Coconut Creek Fl Al Hendrickson Toyota Pt6348

Buy A Used Car In Tulsa Ok Oklahoma Used Vehicle Sales

Oklahoma Senate Passes Bills To Modify Vehicle Sales Tax Registrations Kokh

Certified Pre Owned Cars For Sale In Oklahoma City Bob Moore Auto Group

Used Cars For Sale In Tulsa Ok Under 8 000 Cars Com

New 2022 Jeep New Grand Cherokee Overland 4wd Sport Utility Vehicles In Tulsa N8547492 South Pointe Chrysler Dodge Jeep Ram

New 2023 Kia Sportage X Pro Prestige Near Tulsa Ok Boomer Kia

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price